Himax Technologies Stock: Finally, A Good Level (NASDAQ:HIMX) – Seeking Alpha

da-kuk/iStock via Getty Images

da-kuk/iStock via Getty Images

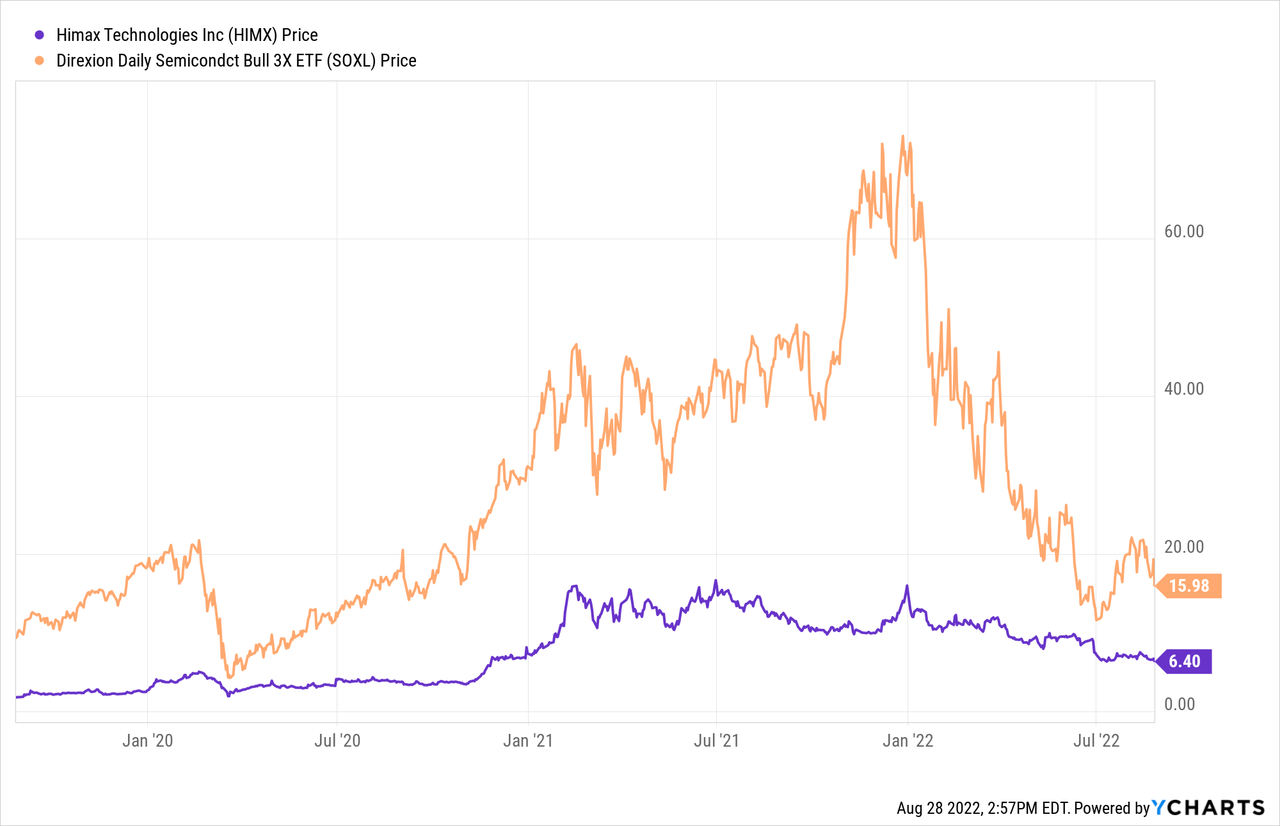

Himax Technologies (NASDAQ:HIMX) is a popular Taiwan-based semiconductor company that gained widespread investor attention when supply chain disruptions brought about by the COVID-19 pandemic and favorable secular trends created a squeeze on semiconductor supplies. This left companies like Himax technologies with heightened pricing power, allowing them to not only pass on costs to customers but also increase their gross margins almost across the board. As the world moves past the pandemic, semiconductor stocks have begun to face headwinds, and Himax perhaps disproportionately so (I have covered Himax multiple times in the past. To view these articles, please search here). Today we will take a look at one of the largest semiconductor companies in the world and discuss if investors are pricing in too much negative news.

When I wrote this article, I cautioned that Himax might begin to see some headwinds due to uncertainties on the customer side and potential geopolitical risks. The stock has declined roughly 30% since then, and we are now beginning to see signs of gross margins being brought back to earth.

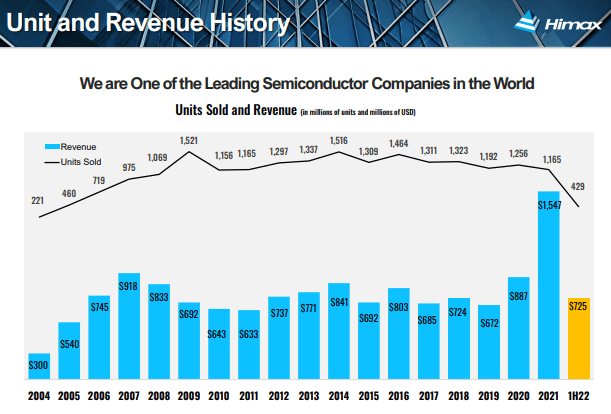

In the recent Q2 earnings report, the company posted revenue of $312.6 million which represented a 24.3% decline from the prior quarter. The company managed to maintain strong gross margins despite a challenging macroeconomic environment. The gross margin came in line with estimates at 43.6%. The company’s non-IFRS after-tax profit was $76.8 million, which represented 43.9 cents per diluted ADS compared to the 69.7 cents in the prior quarter. The company also mentioned that it believes its inventory will peak in the third quarter and shared that its automotive IC business is now the largest segment from a revenue standpoint, and the segment looks set to represent more than 35% of total sales in the third quarter. Despite possible headwinds in Q3, the company is closing an impressive first half of the calendar year 2022. It has already beat revenue figures for the full year 2019, and we may yet see a strong fourth quarter if the expected global economic slowdowns are milder than forecasted and if geopolitical tensions abate.

Himax Product

Himax Product

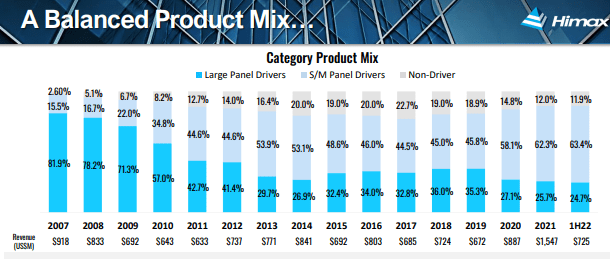

We are also seeing signs of the future for the firm’s internal business lines, with small and medium panel drivers taking up an increased share of company revenue.

Himax Product

Himax Product

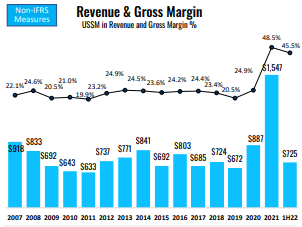

One of the major concerns in the past was a large drop-off in gross margins. As you can see below, the pandemic forced gross margins up to elevated levels, and we are now seeing some normalization. In 2019 gross margins stood at 20.5%, but they reached a high of 48.5% in 2021 due in large part to the semiconductor crisis.

Himax Technologies

Himax Technologies

There were concerns that we could see gross margins falling 3% to 5% a quarter, but they have remained relatively stable, all things considered. They came in at 43.6% this quarter, which is still a decline, but at a rate that shareholders should be able to stomach.

Himax Technologies

Himax Technologies

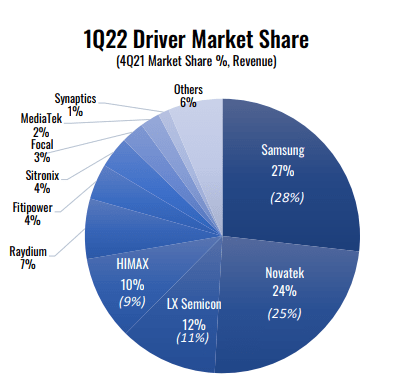

The company’s large display driver IC business continues to be a major contributor, responsible for nearly a quarter of the company’s revenue. The large display drivers are used in 8K/4K TVs and gaming. Himax also has a position in consumer devices, smartphones, and tablets. We can also see that the market for drivers is spread fairly well across multiple companies, which is great because it allows Himax the flexibility of determining if they want to challenge the major players like Samsung or take market share from the smaller, less well-capitalized firms in the future.

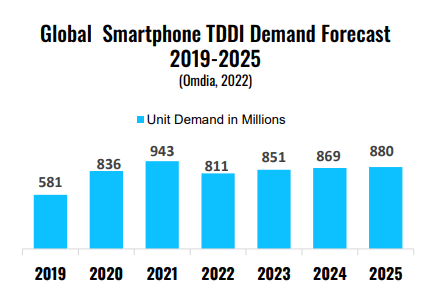

The company is also focusing on its Touch and Display Driver Integration (TDDI) segment. The company began with smartphones but later expanded to tablets and automotive options. Smartphone LCD offerings as a category have penetrated more than 70% of the market and are rapidly replacing the traditional Display Driver IC (“DDIC”) options. Leadership is understandably bullish about the long-term prospects of this option, forecasting higher penetration and improved margins over time. We are also seeing notable increases in customer demand for panel features and size in automobiles, which ties in well with the shift to increasing device complexity that has recently become somewhat of a pronounced secular trend in developed nations.

Himax Technologies

Himax Technologies

The company also holds a strong position in the display driver IC space. It is already a market share leader of large display driver IC products in China and is seeing increased shipments of 4K products, but the firm is targeting improved participation in the development of next Gen 8K televisions. That segment has a higher barrier to entry.

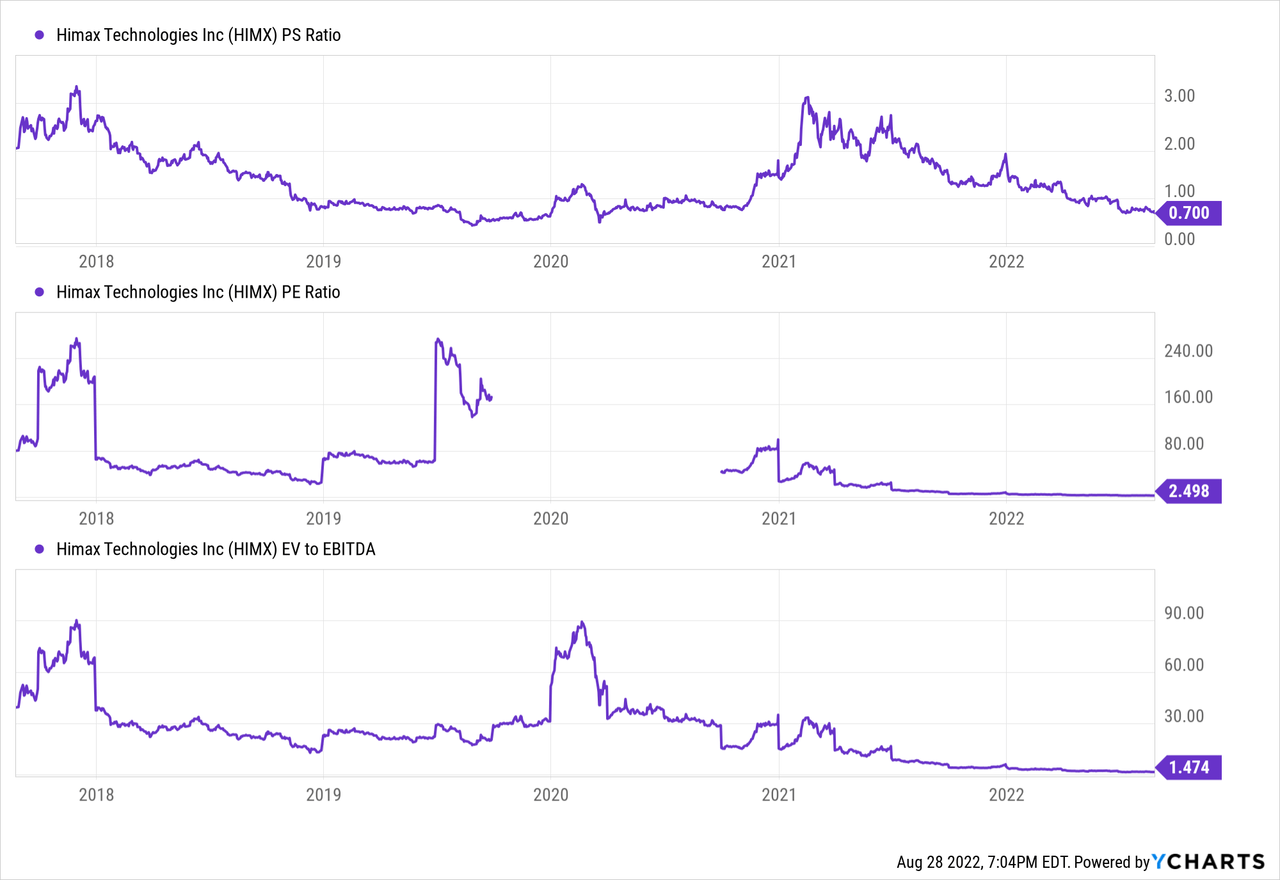

Now let’s start with valuation. Himax shares are trading at just $0.70 per dollar of the company’s revenue and a price-to-earnings ratio of just 2.5. These are extremely low numbers for a semiconductor stock, but there are reasons for the low valuation.

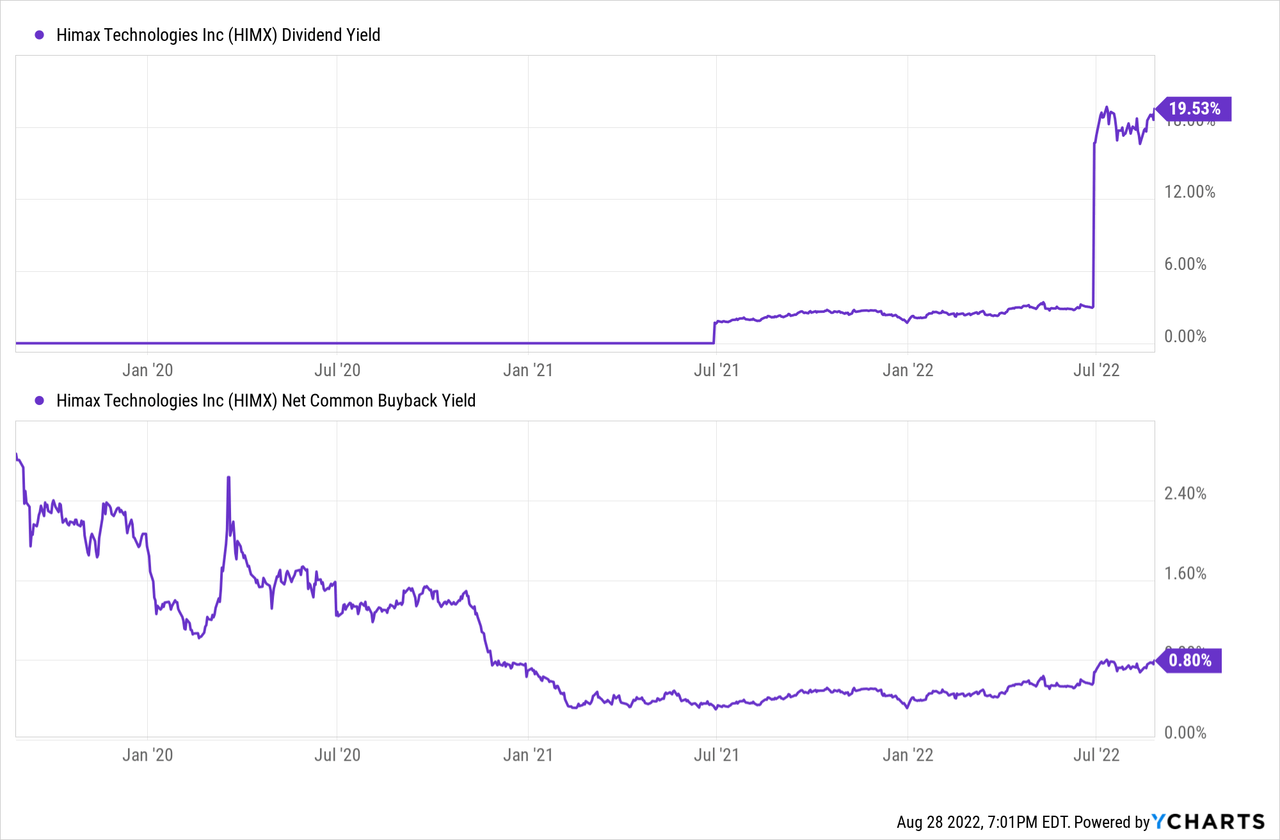

As we mentioned earlier, Himax is a Taiwanese semiconductor company with heavy exposure to China. As tensions between the two nations trend to an escalation, it is understandable that investors may not want to commit to a purchase until the situation improves. There are also the current headwinds for growth stocks like Himax brought about by the Federal Reserve taking on a hawkish approach to address inflation. It is also worth noting that Himax hasn’t really traded at elevated multiples with respect to revenue for some time now. The company does, however, have a great track record of returning cash to shareholders in the form of dividends and repurchases.

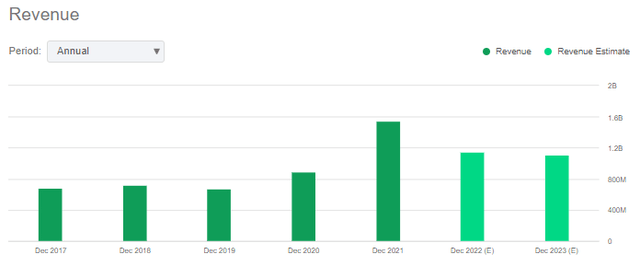

The major trend that investors should be paying attention to is the return to earth from revenue and gross margin standpoints. Revenue looks set to slow down in the calendar year 2022. This has nothing to do with the underlying health of the business, it’s just that Himax had been overperforming, and we are now seeing signs of normalization.

Seeking Alpha

Seeking Alpha

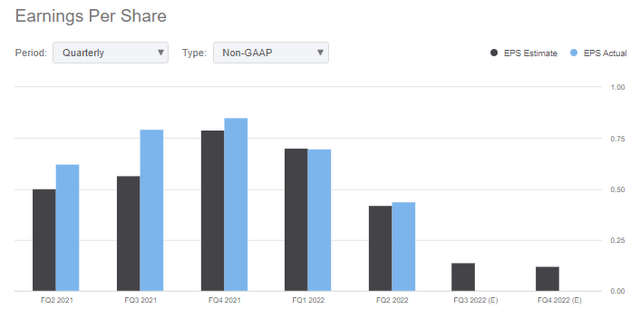

We should also see EPS figures cooled down due to this normalization and possible margin compression. It is important to note that the company has been performing well to expectations, and it would not be a stretch to imagine that they manage to beat expectations even as things trend downwards.

Seeking Alpha

Seeking Alpha

I expect revenue to come in north of $1.1Bn for the calendar year 2022. If we use a modest PS ratio of 2 for our target, we get a $2.2Bn market cap which is good for a price target of $12.6. Taking a 20% margin of safety, we get a price target of $10, which represents a 68% upside from today’s prices.

If we are looking purely at valuation relative to company performance, Himax is an absolute bargain here. There are pronounced geopolitical risks that cannot be ignored, but there also is an awful lot of negativity priced into the stock right now. Any sign of conflict between China and Taiwan would likely ruin any investment thesis here, but the price is almost too low to ignore. Himax is worth a speculative buy here with a long-term price target of $10 per share.

This article was written by

Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, but may initiate a beneficial Long position through a purchase of the stock, or the purchase of call options or similar derivatives in HIMX over the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.