SS&C Technologies (SSNC) Completes Buyout of CFO Fund Services – Zacks Investment Research

We use cookies to understand how you use our site and to improve your experience. This includes personalizing content and advertising. To learn more, click here. By continuing to use our site, you accept our use of cookies, revised Privacy Policy and Terms of Service.

Don't Know Your Password?

New to Zacks? Get started here.

Don't Know Your Password?

You are being directed to ZacksTrade, a division of LBMZ Securities and licensed broker-dealer. ZacksTrade and Zacks.com are separate companies. The web link between the two companies is not a solicitation or offer to invest in a particular security or type of security. ZacksTrade does not endorse or adopt any particular investment strategy, any analyst opinion/rating/report or any approach to evaluating indiv idual securities.

If you wish to go to ZacksTrade, click OK. If you do not, click Cancel.

OK Cancel

Image: Bigstock

Zacks Equity Research

PLXS SSNC SMCI ANET ![]() Trades from $1

Trades from $1

You follow Analyst Blog – edit

You follow Zacks Equity Research – edit

SS&C Technologies Holdings (SSNC – Free Report) announced that it has completed the acquisition of Colorado-based fund administration firm – Complete Financial Ops (CFO) Fund Services – in an all-cash deal. The transaction details have not been revealed.

CFO Fund Services provides customized fund administration services to private equity funds and family offices. The acquisition will assist SS&C in offering services to venture capital and family office funds.

The acquisition will enable SS&C to expand its position as a fund administrator by adding 25 clients and eight employees.

SS&C Technologies Holdings, Inc. price-consensus-chart | SS&C Technologies Holdings, Inc. Quote

SS&C continues to develop its hedge fund, private markets, middle-office and insurance servicing capabilities with more than $2 trillion in alternative assets under management.

The service provided to CFO clients will be supported by SS&C’s breadth, scope and all-inclusive solutions for the alternative management sector.

SS&C provides investment and financial management software and related services primarily to the financial services industry. It delivers mission-critical processing for information management, analysis, trading, accounting, reporting and compliance.

The company expects fourth-quarter revenues to be in the range of $1.305-$1.355 billion. The Zacks Consensus Estimate is pegged at $1.33 billion. Earnings per share are expected to be in the range of $1.12–$1.20. The consensus estimate stands at $1.16 per share.

The company reported third-quarter earnings of $1.15 per share, missing the Zacks Consensus Estimate of $1.17. This compares to earnings of $1.32 per share a year ago.

Adjusted revenues in the quarter were $1.32 billion, missing the Zacks Consensus Estimate by 1.85%. This compares to year-ago revenues of $1.27 billion. The performance was boosted by continued momentum across Advent, I&IM, Private Markets and Retirement solutions.

In the third quarter, the company completed the acquisition of Tier1’s CRM business to expand its footprint in capital markets and investment banking.

However, it struggles with volatile macroeconomic conditions, unfavorable exchange rates and rising interest rates.

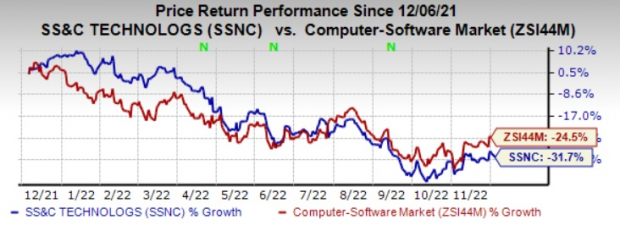

SS&C currently carries a Zacks Rank #4 (Sell). Shares have lost 31.7% compared with the sub-industry’s decline of 24.5% in the past year.

Image Source: Zacks Investment Research

Some better-ranked stocks from the broader technology space are Arista Networks (ANET – Free Report) , Plexus (PLXS – Free Report) and Super Micro Computer (SMCI – Free Report) , each presently sporting a Zacks Rank #1 (Strong Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

The Zacks Consensus Estimate for Arista Networks 2022 earnings is pegged at $4.37 per share, up 8.2% in the past 60 days. The long-term earnings growth rate is anticipated to be 17.5%.

Arista Networks’ earnings beat the Zacks Consensus Estimate in the last four quarters, the average being 12.7%. Shares of ANET have jumped 9.2% in the past year.

The Zacks Consensus Estimate for Plexus 2023 earnings is pegged at $5.98 per share, rising 8.9% in the past 60 days.

Plexus’ earnings beat the Zacks Consensus Estimate in three of the last four quarters, the average being 17.5%. Shares of PLXS have gained 16.7% in the past year.

The Zacks Consensus Estimate for Super Micro Computer’s fiscal 2023 earnings is pegged at $9.58 per share, rising 27.7% in the past 60 days.

Super Micro Computer’s earnings beat the Zacks Consensus Estimate in all of the last four quarters, the average being 9.4%. Shares of SMCI have soared 95.1% in the past year.

Plexus Corp. (PLXS) – free report >>

SS&C Technologies Holdings, Inc. (SSNC) – free report >>

Super Micro Computer, Inc. (SMCI) – free report >>

Arista Networks, Inc. (ANET) – free report >>

Our experts picked 7 Zacks Rank #1 Strong Buy stocks with the best chance to skyrocket within the next 30-90 days.

Recent stocks from this report have soared up to +178.7% in 3 months – this month’s picks could be even better. See our report’s 7 new picks today, absolutely FREE.

Privacy Policy No cost, no obligation to buy anything ever.

This page has not been authorized, sponsored, or otherwise approved or endorsed by the companies represented herein. Each of the company logos represented herein are trademarks of Microsoft Corporation; Dow Jones & Company; Nasdaq, Inc.; Forbes Media, LLC; Investor’s Business Daily, Inc.; and Morningstar, Inc.

Copyright 2022 Zacks Investment Research 10 S Riverside Plaza Suite #1600 Chicago, IL 60606

At the center of everything we do is a strong commitment to independent research and sharing its profitable discoveries with investors. This dedication to giving investors a trading advantage led to the creation of our proven Zacks Rank stock-rating system. Since 1988 it has more than doubled the S&P 500 with an average gain of +24.51% per year. These returns cover a period from January 1, 1988 through September 12, 2022. Zacks Rank stock-rating system returns are computed monthly based on the beginning of the month and end of the month Zacks Rank stock prices plus any dividends received during that particular month. A simple, equally-weighted average return of all Zacks Rank stocks is calculated to determine the monthly return. The monthly returns are then compounded to arrive at the annual return. Only Zacks Rank stocks included in Zacks hypothetical portfolios at the beginning of each month are included in the return calculations. Zacks Ranks stocks can, and often do, change throughout the month. Certain Zacks Rank stocks for which no month-end price was available, pricing information was not collected, or for certain other reasons have been excluded from these return calculations.

Visit Performance Disclosure for information about the performance numbers displayed above.

Visit www.zacksdata.com to get our data and content for your mobile app or website.

Real time prices by BATS. Delayed quotes by Sungard.

NYSE and AMEX data is at least 20 minutes delayed. NASDAQ data is at least 15 minutes delayed.

This site is protected by reCAPTCHA and the Google Privacy Policy and Terms of Service apply.