John Bean Technologies (JBT) Closes Bevcorp Buyout for $290M – Zacks Investment Research

We use cookies to understand how you use our site and to improve your experience. This includes personalizing content and advertising. To learn more, click here. By continuing to use our site, you accept our use of cookies, revised Privacy Policy and Terms of Service.

Don't Know Your Password?

New to Zacks? Get started here.

Don't Know Your Password?

You are being directed to ZacksTrade, a division of LBMZ Securities and licensed broker-dealer. ZacksTrade and Zacks.com are separate companies. The web link between the two companies is not a solicitation or offer to invest in a particular security or type of security. ZacksTrade does not endorse or adopt any particular investment strategy, any analyst opinion/rating/report or any approach to evaluating indiv idual securities.

If you wish to go to ZacksTrade, click OK. If you do not, click Cancel.

OK Cancel

Image: Bigstock

Zacks Equity Research

VMI AIT GEF JBT ![]() Trades from $1

Trades from $1

You follow Analyst Blog – edit

You follow Zacks Equity Research – edit

John Bean Technologies (JBT – Free Report) announced that it has completed the previously announced acquisition of Bevcorp, a beverage processing and packaging solutions provider for $290 million. The acquisition augments JBT’s capabilities in the carbonated beverage processing and packaging market.

Established in 1992, OH-based Bevcorp provides equipment and aftermarket support for the beverage processing and packaging market in the United States. The business provides core technology solutions in blending, handling, filling and closing to a gamut of customers, including blue chip companies.

Bevcorp’s product offerings are used in high-value segments of the beverage market, including carbonated soft drinks, seltzers, carbonated water, energy drinks and ready-to-drink alcoholic blends. It offers a combination of rebuilds, aftermarket components and services in addition to its new equipment offering, which accounts for more than 60% of its recurring revenues.

From September 2022 to December 2022, Bevcorp’s revenues are expected to be $25-$30 million, while an adjusted EBITDA margin is projected in the 23-24% band. The estimated impact of transaction costs, inventory step-up and non-recurring integration costs is expected to be around $9 million.

Bevcorp is not expected to leave a meaningful impact on John Bean Technologies’ adjusted earnings per share in 2022. In 2023, Bevcorp’s top line is expected in the range of $85-$90 million. Adjusted EBITDA margin is expected between 23.5% and 24.5%. Adjusted earnings per share contribution from Bevcorp are likely to be between 8 cents and 12 cents next year.

John Bean Technologies funded the acquisition by utilizing its existing credit facility. This is likely to temporarily increase its net leverage ratio above its target of 2.0-3.0X. JBT expects to lower the ratio below 3.0X by this year-end.

JBT has a strategic acquisition program focused on companies that add complementary products, thus enabling it to offer more comprehensive solutions to customers. In 2021, John Bean Technologies bought AutoCoding Systems to strengthen its abilities in the growing global market for in-line coding and inspection solutions. It also wrapped up the buyout of Prevenio, expanding its recurring revenue stream and strengthening its ability to address the food safety needs of customers. JBT closed the buyout of Urtasun in the fourth quarter of 2021, which extended its product offering in fruit and vegetable processing.

Earlier this year, John Bean Technologies acquired Alco-food-machines GmbH & Co. KG (Alco), a leading provider of food processing solutions and production lines. The takeover expands JBT’s offering in convenience meal lines, and alternative and plant-based protein technology. JBT expects this deal to be approximately two cents accretive to its adjusted earnings per share in the current year.

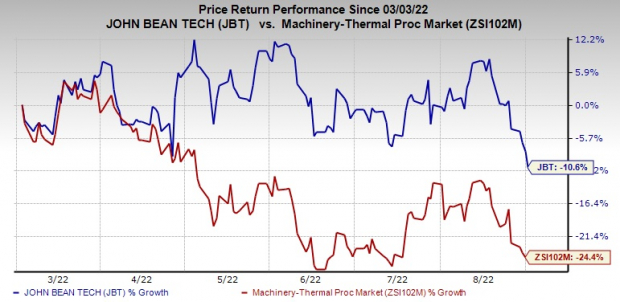

Image Source: Zacks Investment Research

Shares of John Bean Technologies have declined 10.6% in the past six months compared with the industry’s plunge of 24.4%.

John Bean Technologies currently carries a Zacks Rank #4 (Sell).

Some better-ranked stocks from the Industrial Products sector are Applied Industrial Technologies, Inc. (AIT – Free Report) , Greif, Inc. (GEF – Free Report) and Valmont Industries, Inc. (VMI – Free Report) . While AIT sports a Zacks Rank #1 (Strong Buy), GEF and VMI carry a Zacks Rank #2 (Buy) at present. You can see the complete list of today’s Zacks #1 Rank stocks here.

AIT’s earnings estimates have increased 5.8% for fiscal 2023 (ending June 2023) in the past 60 days.

Applied Industrial pulled off a trailing four-quarter earnings surprise of 22.8%, on average. AIT’s shares have gained 3% in the past six months.

Greif presently has a Zacks Rank of 2. GEF delivered a trailing four-quarter earnings surprise of 22.9%, on average.

GEF’s earnings estimates have increased 0.4% for fiscal 2022 (ending October 2022) in the past 60 days. Its shares have risen 11.6% in the past six months.

Valmont presently has a Zacks Rank of 2. VMI’s earnings surprise in the last four quarters was 13.7%, on average.

In the past 60 days, Valmont’s earnings estimates have increased 3.8% for 2022. The stock has rallied 25.3% in the past six months.

Valmont Industries, Inc. (VMI) – free report >>

Applied Industrial Technologies, Inc. (AIT) – free report >>

Greif, Inc. (GEF) – free report >>

John Bean Technologies Corporation (JBT) – free report >>

Our experts picked 7 Zacks Rank #1 Strong Buy stocks with the best chance to skyrocket within the next 30-90 days.

Recent stocks from this report have soared up to +178.7% in 3 months – this month’s picks could be even better. See our report’s 7 new picks today, absolutely FREE.

Privacy Policy No cost, no obligation to buy anything ever.

This page has not been authorized, sponsored, or otherwise approved or endorsed by the companies represented herein. Each of the company logos represented herein are trademarks of Microsoft Corporation; Dow Jones & Company; Nasdaq, Inc.; Forbes Media, LLC; Investor’s Business Daily, Inc.; and Morningstar, Inc.

Copyright 2022 Zacks Investment Research 10 S Riverside Plaza Suite #1600 Chicago, IL 60606

At the center of everything we do is a strong commitment to independent research and sharing its profitable discoveries with investors. This dedication to giving investors a trading advantage led to the creation of our proven Zacks Rank stock-rating system. Since 1988 it has more than doubled the S&P 500 with an average gain of +24.41% per year. These returns cover a period from January 1, 1988 through July 4, 2022. Zacks Rank stock-rating system returns are computed monthly based on the beginning of the month and end of the month Zacks Rank stock prices plus any dividends received during that particular month. A simple, equally-weighted average return of all Zacks Rank stocks is calculated to determine the monthly return. The monthly returns are then compounded to arrive at the annual return. Only Zacks Rank stocks included in Zacks hypothetical portfolios at the beginning of each month are included in the return calculations. Zacks Ranks stocks can, and often do, change throughout the month. Certain Zacks Rank stocks for which no month-end price was available, pricing information was not collected, or for certain other reasons have been excluded from these return calculations.

Visit Performance Disclosure for information about the performance numbers displayed above.

Visit www.zacksdata.com to get our data and content for your mobile app or website.

Real time prices by BATS. Delayed quotes by Sungard.

NYSE and AMEX data is at least 20 minutes delayed. NASDAQ data is at least 15 minutes delayed.

This site is protected by reCAPTCHA and the Google Privacy Policy and Terms of Service apply.