SoFi Technologies: It May Get Worse For This Penny Stock … – Seeking Alpha

martin-dm

martin-dm

This year, SoFi Technologies, Inc. (NASDAQ:SOFI) has taken a significant valuation hit. The stock has fallen 72% year-to-date, and despite the fact that the company’s CEO doubled down on SOFI in December, I believe SOFI will challenge its recent 52-week lows.

The absence of a positive and long-lasting market reaction to the CEO’s transactions strongly suggests that SOFI’s stock price weakness will continue in the short term.

SOFI may suffer further capital losses in 2023 due to both a deteriorating chart profile and fundamental business challenges for which the company has yet to find a solution.

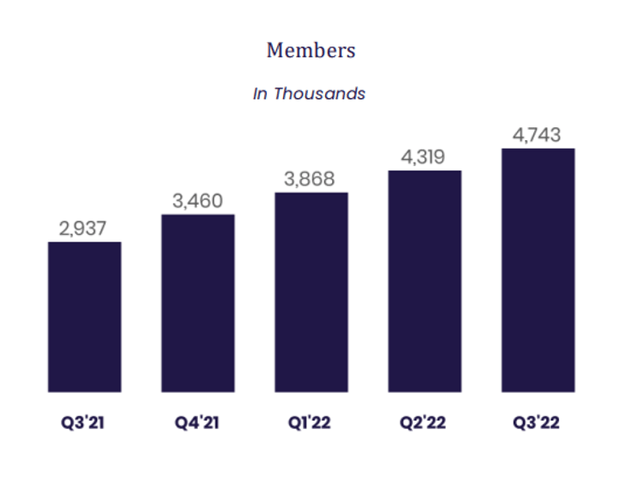

If you invested $10K in SoFi Technologies on January 1, 2022, your investment is now worth $2.7K. This represents a negative total return of 72%, despite the company continuing to experience strong member growth throughout 2022.

SOFI added 1.28 million members to its business this year, indicating that customers continue to value the fintech’s services.

Member Growth (SoFi Technologies)

Member Growth (SoFi Technologies)

SOFI also raised its 2022 sales and adjusted EBITDA guidance, but investors are still skeptical of the fintech’s potential despite a dramatic shift in sentiment this year.

I previously stated that investors are less forgiving today than they were during the pandemic and expect fintechs to provide a clear roadmap to profitability.

Unfortunately, as I have previously stated, SoFi Technologies is only profitable on an adjusted EBITDA basis, as are most companies, and thus this figure is meaningless.

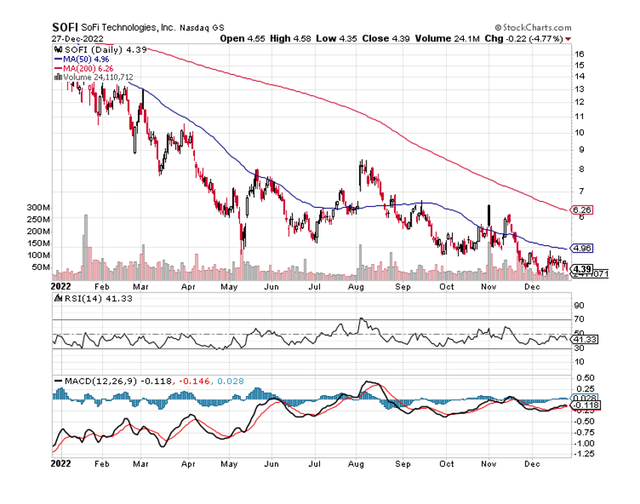

Despite the fact that SOFI has experienced a significant valuation decline this year (and is now officially a penny stock trading below $5), the deteriorating chart profile strongly suggests that SOFI is likely to perform poorly in 2023.

One major negative indicator was SoFi Technologies’ breach of the 50-day moving average line in November, which is currently at $4.96. The absence of a recapture attempt suggests that SoFi Technologies’ stock has lost strength and momentum, and even positive news in the form of insider transactions didn’t help the bulls much.

What’s also concerning about SoFi Technologies’ chart is that an important long-term support level at $5 was broken in November, and the stock has yet to recover.

The next level for investors to watch is $4.24, which is SoFi Technologies’ all-time low. A break of this level could exacerbate the stock’s negative momentum, which has been evident for some time. While not yet oversold, the trends clearly point to SOFI’s downside.

Moving Average (StockCharts.com)

Moving Average (StockCharts.com)

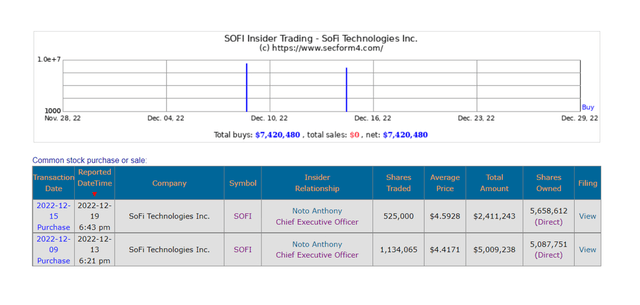

Recently, it was revealed that the company’s CEO, Anthony Noto, purchased a large amount of SoFi Technologies stock in multiple transactions.

The CEO purchased 300K shares on December 16th at a weighted-average price of $4.59, and the day before that he purchased 225K shares at the same price, $4.59.

Following that, the CEO held approximately $25 million in stock in the fintech, for a total share position of 5.66 million. SoFi Technologies’ CEO paid $7.4 million for 1.66 million shares in all transactions considered in December.

Insider Trading (Secform4.com)

Insider Trading (Secform4.com)

Unfortunately, the transactions did little to improve investor confidence in SoFi Technologies, and the stock has continued to fall. CEO transactions are frequently scrutinized because they can provide investors with insight into how the leadership views the company and whether they believe it is under- or overvalued.

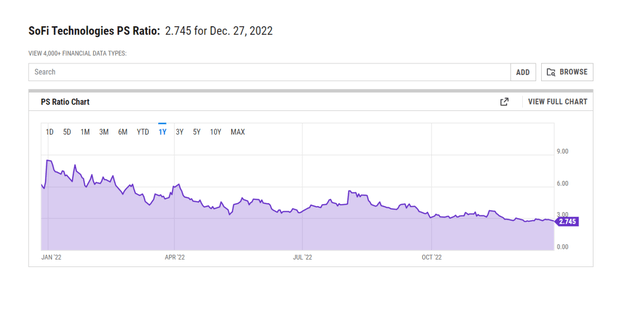

SoFi Technologies’ stock is currently trading at a P/S ratio of 2.75x at the time of writing. Since SOFI’s stock price dropped significantly in 2022, the P/S-ratio has also dropped significantly this year.

In January, investors paid as much as 9x sales for the privilege of investing in this fintech company. I continue to believe that SOFI is overvalued, given that strong member growth rates have yet to translate into actual profits.

PS Ratio (YCharts)

PS Ratio (YCharts)

Profit visibility is the one factor that I believe can make a significant difference for the fintech. An upside retracement is possible if the CEO not only buys his own stock but also leads the company to profitability.

One of my main criticisms of SOFI was that it only achieves profitability on an adjusted EBITDA basis. During the pandemic, investors were willing to place a high value on fintechs like SOFI, but the game has changed, and investors now want to see fintechs generate tangible profits.

If SoFi Technologies is successful, the company may be rewarded with a higher sales multiple.

SoFi Technologies’ chart profile, as well as the fact that the CEO’s transactions had no impact on investors or the market, attest to investors’ disdain for loss-making fintech companies at the moment.

While SoFi Technologies, Inc. is still rapidly expanding its membership, the fintech is still only profitable on an adjusted EBITDA basis, and this is unlikely to change in 2023.

Because SoFi Technologies, Inc. stock is now a penny stock (trading below $5) and the chart picture has deteriorated significantly in December, I believe investors should avoid SOFI.

This article was written by

Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.