Synchronoss Technologies Seeks Growth Amid Cloud Transition (NASDAQ:SNCR) – Seeking Alpha

marchmeena29

marchmeena29

Synchronoss Technologies, Inc. (NASDAQ:SNCR) recently reported its Q2 2022 financial results on August 9, 2022 as it continues its transition to a cloud-first strategy.

The company provides a range of software communication, onboarding and network management tools to businesses.

Given SNCR’s flat forward revenue growth guidance, it is difficult to ascertain a meaningful catalyst to the stock in the near term.

I’m on Hold for SNCR for the remainder of 2022.

Bridgewater, New Jersey-based Synchronoss was founded in 2000 to provide a suite of storage, messaging, commerce solutions, customer experience and network infrastructure design and management solutions to businesses.

The firm is headed by Chief Executive Officer Jeff Miller, who was previously President of IDEAL Industries Technology Group and Corporate Vice President of North America for Motorola Mobility.

The company’s primary offerings include:

engageX – communication and engagement tools

onboardX – subscriber onboarding

networkX – network management

The firm acquires customers through its direct sales, marketing and inside sales team efforts.

According to a recent market research report by Mordor Intelligence, the market for customer engagement solutions was an estimated $15.5 billion in 2020 and is forecast to reach nearly $31 billion by 2026.

This represents a forecast CAGR of 12.65% from 2021 to 2026.

The main drivers for this expected growth are increasing usage of customers of smartphones and a desire by businesses to connect more frequently and meaningfully with prospects and customers in a more automated and cost-efficient manner.

Also, the Retail and Consumer Goods industries are expected to account for a considerable market share of demand for solutions while the North American region is forecast to retain the highest market share by region, with the Asia Pacific region expected to produce high growth during the period.

Major competitive or other industry participants include:

Avaya

Aspect Software

Calabrio

Genesys

IBM

Verint Systems

NICE Systems

Nuance Communications

OpenText

Oracle

Pegasystems

The company also has products in other industry verticals such as network management and subscriber onboarding.

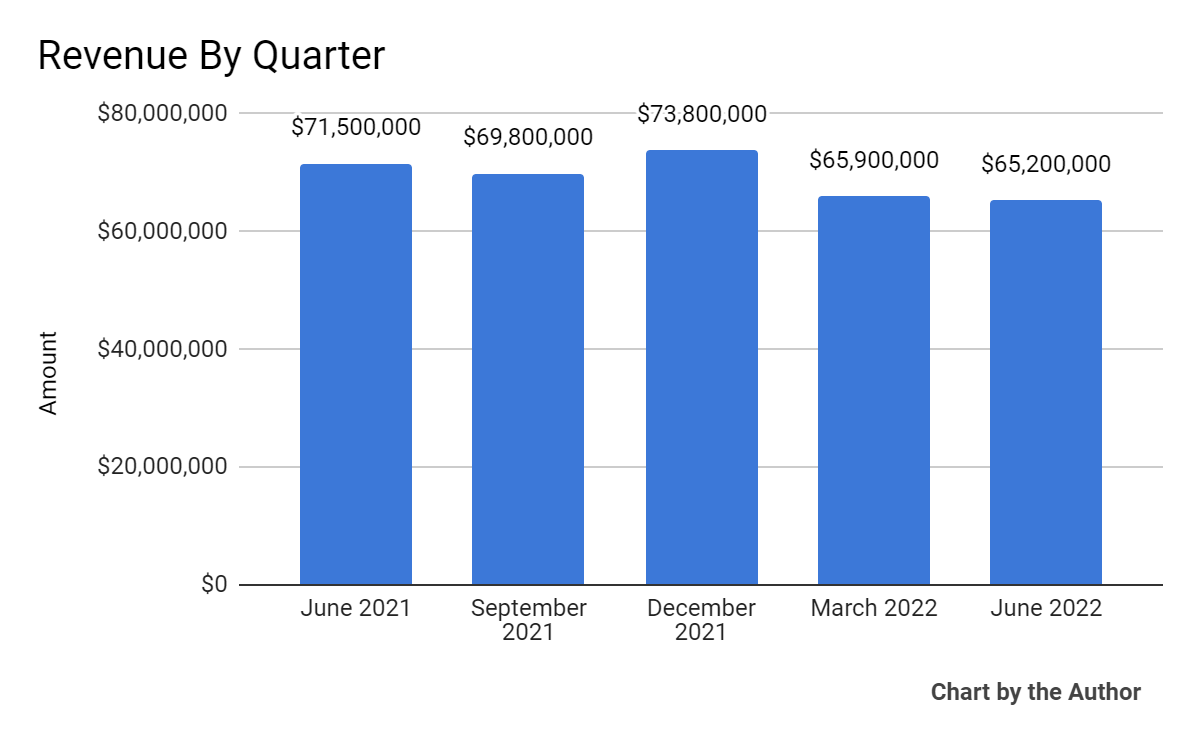

Total revenue by quarter has produced uneven and slightly lower results recently:

5 Quarter Total Revenue (Seeking Alpha)

5 Quarter Total Revenue (Seeking Alpha)

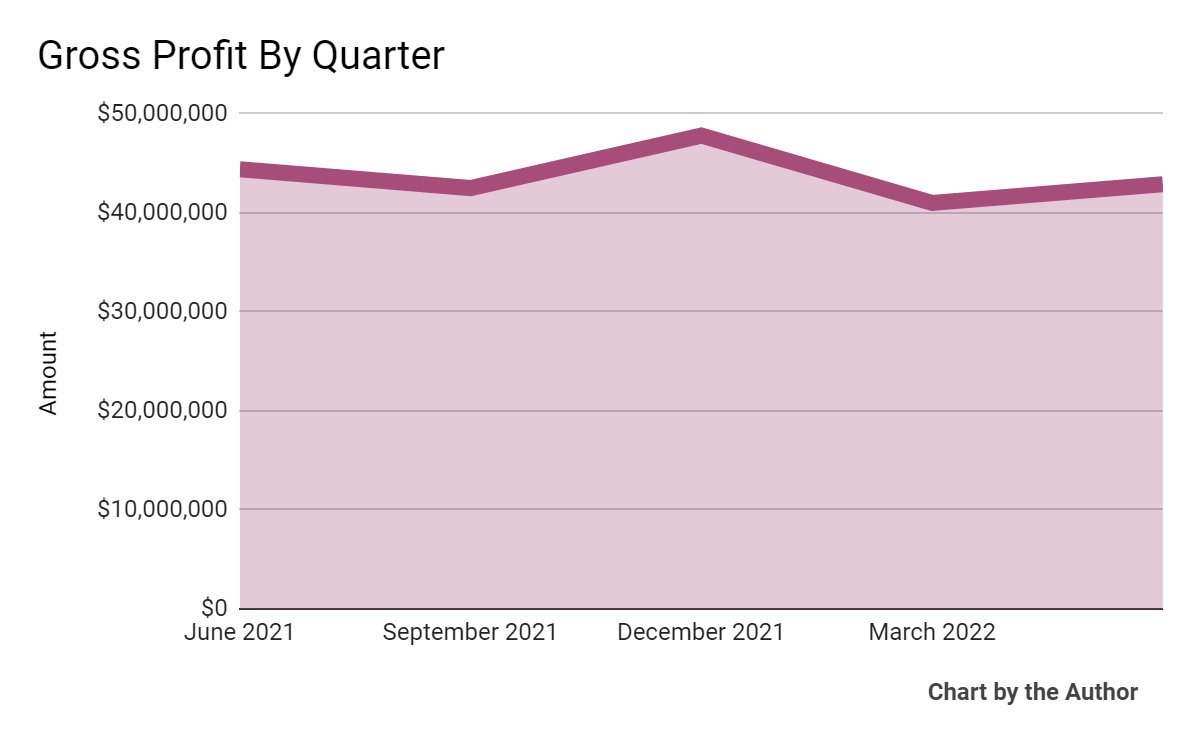

Gross profit by quarter has also plateaued or dropped slightly:

5 Quarter Gross Profit (Seeking Alpha)

5 Quarter Gross Profit (Seeking Alpha)

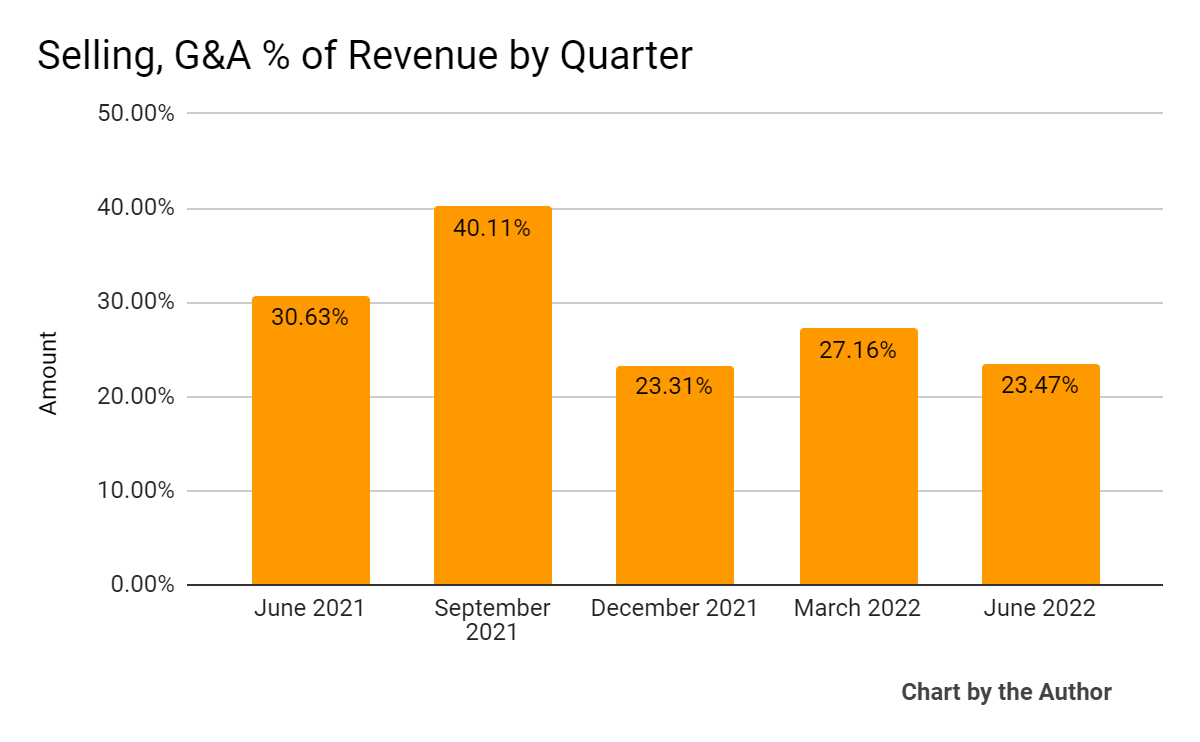

Selling, G&A expenses as a percentage of total revenue by quarter have resulted as the chart shows below:

5 Quarter SG&A % Of Revenue (Seeking Alpha)

5 Quarter SG&A % Of Revenue (Seeking Alpha)

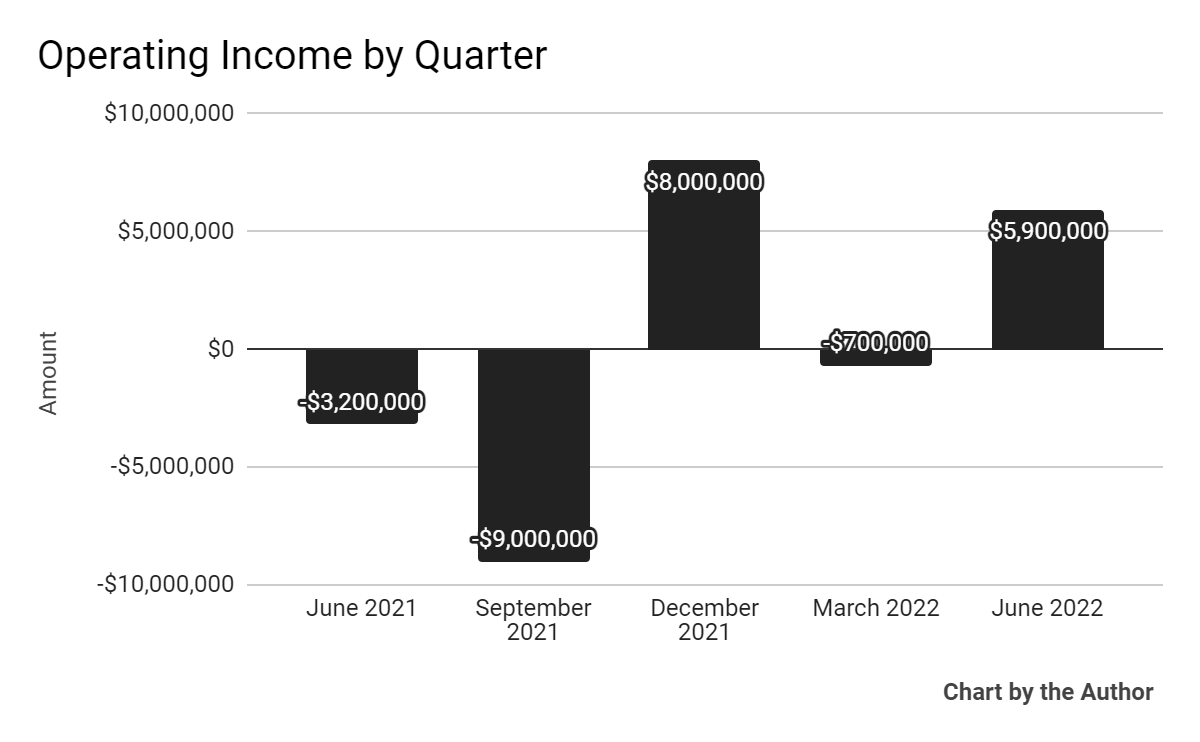

Operating income by quarter has been uneven but trending positive in some recent reporting periods:

5 Quarter Operating Income (Seeking Alpha)

5 Quarter Operating Income (Seeking Alpha)

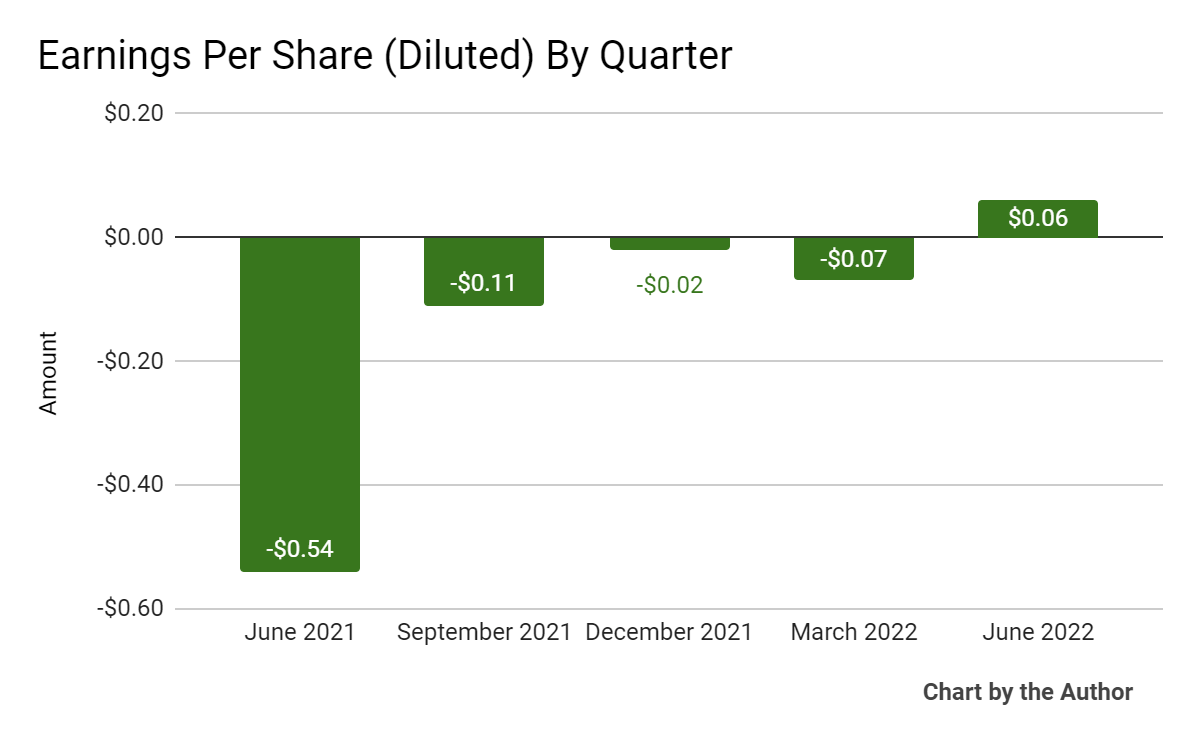

Earnings per share (Diluted) have turned positive in the most recent quarter:

5 Quarter Earnings Per Share (Seeking Alpha)

5 Quarter Earnings Per Share (Seeking Alpha)

(All data in above charts is GAAP)

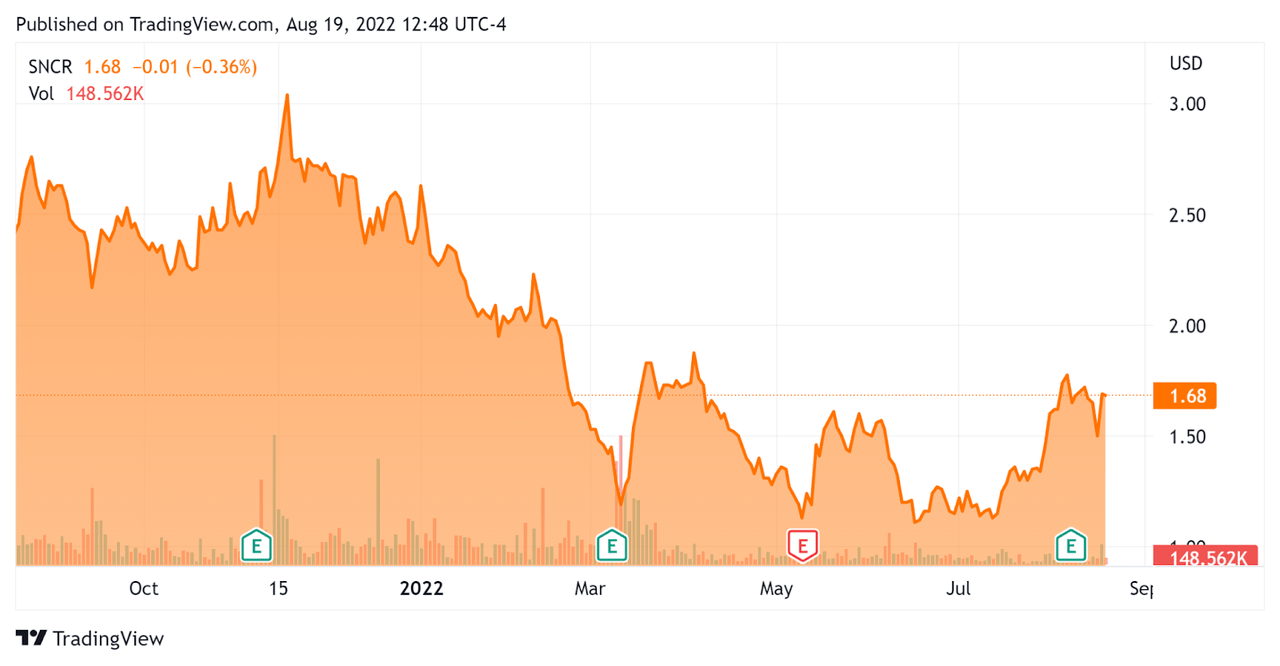

In the past 12 months, SNCR’s stock price has dropped 29.9% vs. the U.S. S&P 500 Index’s drop of around 3.8%, as the chart below indicates:

52 Week Stock Price (Seeking Alpha)

52 Week Stock Price (Seeking Alpha)

Below is a table of relevant capitalization and valuation figures for the company:

Measure (TTM)

Amount

Enterprise Value/Sales

1.37

Revenue Growth Rate

-0.1%

Net Income Margin

-1.4%

GAAP EBITDA %

7.8%

Market Capitalization

$149,600,000

Enterprise Value

$377,300,000

Operating Cash Flow

$3,510,000

Earnings Per Share (Fully Diluted)

-$0.14

(Source – Seeking Alpha)

The Rule of 40 is a software industry rule of thumb that says that as long as the combined revenue growth rate and EBITDA percentage rate equal or exceed 40%, the firm is on an acceptable growth/EBITDA trajectory.

SNCR’s most recent GAAP Rule of 40 calculation was 7.7% as of Q2 2022, so the firm needs significant improvement in this regard, per the table below:

Rule of 40 – GAAP

Calculation

Recent Rev. Growth %

-0.1%

GAAP EBITDA %

7.8%

Total

7.7%

(Source – Seeking Alpha)

In its last earnings call (Source – Seeking Alpha), covering Q2 2022’s results, management highlighted the growth of its cloud revenue portion, now at around two-thirds of total revenue as the firm transitions to a cloud-based delivery approach.

However, the macroeconomic slowdown has started causing delays in sales cycles in certain aspects of its business.

The company intends to reduce complexity in its offerings while continuing to emphasize its cloud transition.

As to its financial results, total revenue dropped while cloud revenue rose. Digital revenue dropped due to asset divestitures and messaging revenue dropped sharply “as anticipated due to the dissolution of the cross-carrier messaging initiative that occurred in 2021.”

Notably, management did not discuss any retention metrics, unusual for a primarily subscription software company.

Gross profit decreased by margin increased due to growing revenue from its higher-margin cloud products and cost savings efforts.

For the balance sheet, the firm ended the quarter with $25.5 million in cash and equivalents and positive free cash flow of $3.6 million. SNCR had long-term debt of $133.8 million.

Looking ahead, management believes it can “sustain our double-digit subscriber growth” through marketing its Cloud system to customers.

For fiscal 2022, revenue is expected by management to be flat “after adjusting for the sale of DXP and Activation assets,” while adjusted EBITDA is forecast to be at around $51.5 million at the midpoint.

Regarding valuation, the market is valuing SNCR at an EV/Sales multiple of around 1.4x.

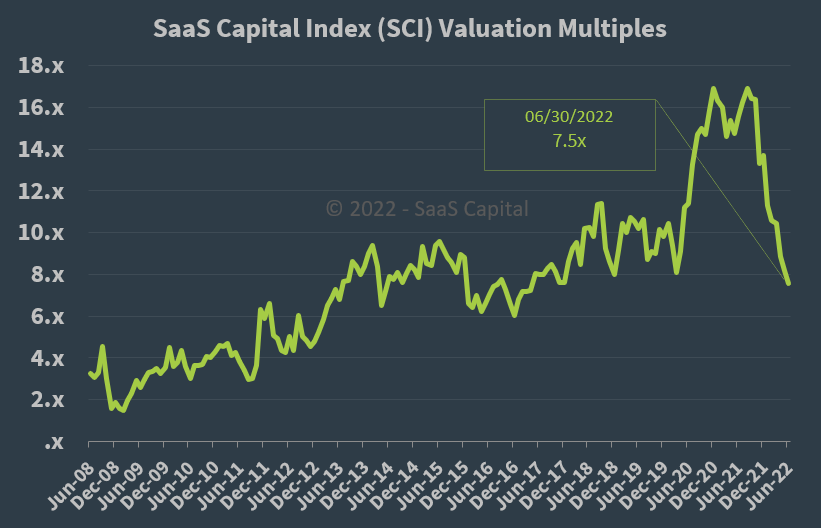

The SaaS Capital Index of publicly held SaaS software companies showed an average forward EV/Revenue multiple of around 7.5x at June 30, 2022, as the chart shows here:

SaaS Capital Index (Seeking Alpha)

SaaS Capital Index (Seeking Alpha)

So, by comparison, SNCR is currently valued by the market at a significant discount to the SaaS Capital Index, at least as of June 30, 2022.

The primary risk to the company’s outlook is a potential macroeconomic slowdown or recession, which may slow sales cycles and reduce its revenue growth trajectory.

The firm is clearly making progress in its transition to a cloud-based approach, but now management has to prove that it can grow net revenue with cloud subscription growth against the fall off from its legacy solutions.

While I wish SNCR well, given its flat growth guidance, it is difficult to ascertain a meaningful catalyst to the stock in the near term.

I’m on Hold for SNCR for the remainder of 2022.

Gain Insight and actionable information on U.S. IPOs with IPO Edge research.

Members of IPO Edge get the latest IPO research, news, and industry analysis.

Get started with a free trial!

This article was written by

I’m the founder of IPO Edge on Seeking Alpha, a research service for investors interested in IPOs on US markets. Subscribers receive access to my proprietary research, valuation, data, commentary, opinions, and chat on U.S. IPOs. Join now to get an insider’s ‘edge’ on new issues coming to market, both before and after the IPO. Start with a 14-day Free Trial.

Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Additional disclosure: This report is intended for educational purposes only and is not financial, legal or investment advice. The information referenced or contained herein may change, be in error, become outdated and irrelevant, or removed at any time without notice. You should perform your own research for your particular financial situation before making any decisions.